EBF REACTION

EBF Response: Consultation on proposed RTS in the context of the EBA’s response to the European Commission’s Call for advice on new AMLA mandates

x

Brussels, 11 June 2025 – The European Banking Federation (EBF) has submitted its response to the European Banking Authority (EBA) on the proposed Regulatory Technical Standards (RTS) in the context of the EBA’s response to the European Commission’s Call for advice on the new AML Authority (AMLA) mandates. The EBF welcomes the EBA’s efforts to strengthen the EU’s AML/CFT framework through the RTS. EBF concerns remain with respect to the clarity and feasibility of the proposed measures which should not impose a disproportionate burden on society.

Key Concerns and Recommendations:

- Need for harmonised risk assessment: The current delegation of guidance to national supervisors risks fragmentation and increased compliance burdens.

- Operational and cost implications: With 272 data points proposed for assessment of inherent and residual risks, the RTS impose a disproportionate burden on financial institutions under very tight time frames. The EBF urges the EBA to identify a core set of critical data points for initial implementation.

- Clarification on group-wide reporting: EBF seeks clarity on the scope of group-level assessments, especially regarding application to non-EU-based obliged entities, shared clients, and the treatment of intragroup transactions.

- Proportional customer due diligence (CDD): The EBF stresses the importance of a risk-based approach to customer identification and verification. It warns against overly prescriptive requirements that could hinder financial inclusion, customer experience, and increase compliance costs without significantly improving AML outcomes.

- Risk-sensitive measures: The EBF supports Simplified (SDD) for non-high-risk customers and calls for targeted Enhanced Due Diligence (EDD) measures based on actual risk exposure, along with more proportionate standards regarding Politically Exposed Persons (PEPs).

- Sanctions screening: The EBF recommends aligning screening obligations with existing EU best practices and clarifying the scope of screening to avoid unnecessary operational burdens. EBF believes that screening should be focused on the customer and individuals or entities that ultimately own or control the customer, allowing identification of persons with meaningful ownership or control.

EBF supports the EBA’s goal of a robust and harmonised AML framework. We emphasise that the RTS must be practical, proportionate, and risk-based to be effective.

Our recommendations aim to ensure that compliance efforts are focused where they matter most (i.e. the most substantial risks) while avoiding unnecessary complexity and cost.

The EBF remains committed to working with the EBA, AMLA, and the Commission to ensure the successful implementation of the AMLR and the development of a coherent, efficient, and effective AML/CFT regime across the EU.

X

For more information please contact:

Roger Kaiser, Head of Tax and Compliance, r.kaiser@ebf.eu

Nicholas Soutar, Policy Adviser, n.soutar@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The federation is committed to a thriving European economy that is underpinned by a stable, secure, and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

The post EBF Response: Consultation on proposed RTS in the context of the EBA’s response to the European Commission’s Call for advice on new AMLA mandates appeared first on EBF.

]]>EBF Contributes to Critical Resource to Enhance Cooperation Between Financial Institutions and Law Enforcement

EBF Contributes to Critical Resource to Enhance Cooperation Between Financial Institutions and Law Enforcement

Brussels, 30 January 2025 – The Europol Financial Intelligence Public Private Partnership (EFIPPP) has developed a “Practical Guide for Operational Cooperation between Investigative Authorities and Financial Institutions” to facilitate the criminal law investigative authorities in contributing to operational public-private partnerships (PPPs) in the EU.

The Guide is designed to empower criminal law authorities across the EU to engage more effectively in PPPs and lays the groundwork for transformative cooperation in the fight against financial crime.

It builds on foundational work, such as the 2022 staff working paper produced by DG FISMA, representing the preeminent resource for EU criminal law authorities to assess anti-money laundering (AML) / countering the financing of terrorism (CFT) PPPs, particularly in terms of how they can play a role in contributing to – or establishing – these cooperative mechanisms. Of particular relevance is the fact that the Guide is formulated to account for the nuanced approach required in civil code jurisdictions for these matters. It builds on EFIPPP’s own experience as a successful PPP, as well as other existing cooperative mechanisms. EFIPPP’s mix of expertise, in which the EBF is heavily involved, allows it to provide useful insights in the Guide that can be addressed to policymakers, investigative authorities, as well as private stakeholders, outlining suggestions on how best to enhance operational cooperation both from a legal and practical perspective.

The European Banking Federation (EBF) was involved in the editorial team behind the Guide, along with the Royal United Services Institute (RUSI) Future of Financial Intelligence Sharing (FFIS) programme, and Deloitte. The Guide is accompanied by a “Technical Annex: European Survey of Operational Public-Private Cooperation to Tackle Financial Crime in 2024”, which provides extensive insights into existing PPPs, standing as one of the most comprehensive surveys on operational PPPs in the field of financial crime to date.

With the support for the Guide from both DG FISMA and DG HOME, as well as the substantial opportunity created by the Anti-Money Laundering Regulation (AMLR) Article 75, there is a clear impetus moving towards encouraging AML/CFT cooperation mechanisms/PPPs becoming the “new normal” across the EU.

This collaborative effort, led by Dr. Benjamin Vogel (Max Planck Institute), alongside contributors from RUSI, Deloitte, and the EBF, signals a turning point in Europe’s approach to combating financial crime.

The EBF hopes that this document marks a new stage in the fight against financial crime. Now is the time for policymakers and industry practitioners to step forward to help build and strengthen PPPs across Member States. The Guide takes a positive step in putting partnerships at the forefront of Europe’s fight against financial crime.

Wim Mijs, CEO, commented: “The EBF is a proud partner of the leading cross-border community fostered by EFIPPP in the fight against financial crime. The insights shared in today’s Practical Guide highlight the power of trust and collaboration when working with European authorities. This guide offers valuable insights for building impactful operational public-private partnerships and driving meaningful action against financial crime.“

For more information:

Roger Kaiser, Head of Tax and Compliance, r.kaiser@ebf.eu

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

Stay in touch with the EBF

The EBF produces a daily and a weekly newsletter with European banking news and updates from national banking associations across Europe. CLICK HERE TO SUBSCRIBE

Popular Posts

Sorry. No data so far.

Recent Publications

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

The post EBF Contributes to Critical Resource to Enhance Cooperation Between Financial Institutions and Law Enforcement appeared first on EBF.

]]>EBF reaction to EU AML/CFT framework

EBF REACTION

EBF reaction to EU AML/CFT framework

x

BRUSSELS, 26 May 2023 – The European Banking Federation (EBF) is fully supportive of the European Commission and the co-legislators’ overarching objective to improve the effectiveness of the current EU AML/CFT framework. Bearing in mind the necessary lead-time and efforts to get the AML Package adopted and implemented, this momentum is a unique opportunity to improve the framework and cannot be missed.

The EBF has carefully studied the positions reached in both the Council and the European Parliament on the new AML Regulation, AML Directive and for the Regulation on establishing a new AML Authority. In doing so, we have carefully identified several key issues of the three proposals from the perspective of European financial institutions:

- The EBF welcomes the view of the co-legislators to explicitly recognise the benefits stemming from information sharing for AML/CFT purposes. To this aim, we emphasise the importance of having a sound legal basis for exchanging AML/CFT data supplemented by appropriate safeguards to ensure that the data is protected.

- We support the Council and Commission’s proposal to maintain the 25% threshold for determining beneficial ownership which is aligned with international standards. We caution that the Parliament’s proposal to lower the threshold is not aligned with the risk-based approach and would lead to disproportionate effects. Likewise, the Parliament’s approach to expand the scope of PEPs would impose significant burden for banks and customers alike.

- We caution that the intertwining of AML/CFT with sanctions obligations could have unintended consequences, particularly in terms of supervision.

- The EBF expresses concern with the Council’s proposal to prohibit entering into a business relationship with entities incorporated outside the Union whose information is not held in an EU UBO register. In view of obliged entities’ obligation to identify and verify beneficial ownership information, this information would be readily available in case it was required by competent authorities. As a result, the prohibition will likely impact EU competitiveness and introduce friction into the ordinary course of business without a substantiated AML/CFT purpose.

- The EBF calls for a stronger focus on the risk-based approach to updating customer information. The proposed 5-year limit will impose disproportionate requirements given the large proportion of low-risk customers whose information would change only marginally in this timeframe, if at all. We recommend that firms are permitted to apply a defensible and documented risk-based approach to ongoing monitoring that is subject to review by supervisors.

- The EBF stresses the importance of following a risk-based approach in developing AMLA’s methodology for selection of obliged entities that would fall under its direct supervision. To target the riskiest entities, it is key to put the focus on residual risk from the first selection process.

- We call for stronger UBO registers that hold accurate, adequate and up-to-date information. Ensuring the reliability of registers is essential for the industry in the fight against financial crime.

X

For more information please contact:

Roger Kaiser

Senior Policy Adviser – Fiscal & Anti-Money Laundering, R.Kaiser@ebf.eu

Eduard Hovsepyan

Policy Adviser – Anti-Money Laundering, e.hovsepyan@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The federation is committed to a thriving European economy that is underpinned by a stable, secure, and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

A more in-depth analysis of the position of the European financial institutions can be found in the documents below.

The post EBF reaction to EU AML/CFT framework appeared first on EBF.

]]>EBF position on the DEBRA proposal

EBF POSITION PAPER

x

EBF position on the DEBRA proposal

x

BRUSSELS, 12 September 2022 – The EBF agrees with the over-arching principle of mitigating the tax induced debt-equity bias in corporate investment decisions to render financing more accessible to EU business and to promote the integration of national capital markets into a genuine single market. As expressed by the EBF by itself and also in the context of the Markets4Europe campaign which it founded and led prior to the creation of the CMU Action Plan, the European banking sector believes that promoting equity markets for companies seeking risk capital is in the interest of the EU’s competitiveness and also in the long-term interest of the banks, which will stand to gain from greater equity market business as users of equity markets and also as providers of services to companies accessing equity markets.

We are aware that a proposal of this nature may have a net impact on fiscal revenue, which may be one of the considerations for Member States to take into account as they evaluate the different options to achieve the objective of the proposal, which is to promote equity issuance. At the same time, in our view, an EU regime aimed at this objective must also fulfil the following principles:

It must reduce the tax bias in favour of corporate debt by making capital raising more attractive rather than by making corporate debt more costly for the borrowers;

It must treat all equity issuers in the same way, without creating a different category of issuer; and

It must foster a level playing field among issuers from different Member States, in line with both the Banking Union and the Capital Markets Union.

Further reflection is necessary to ascertain the scope of the proposal, in particular to determine which type of equity should be included as well as the time period to apply the mechanism.

For more information:

Burçak Inel, Director of Financing Sustainable Growth, b.inel@ebf.eu

Marta Morellato, Policy Adviser, Sustainable Finance, m.morellato@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF position on the DEBRA proposal appeared first on EBF.

]]>EBF feedback to the European Commission’s proposed AML Package

h

EBF feedback to the European Commission’s proposed AML Package

x

BRUSSELS, 10 January 2022 – The EBF has provided feedback to the European Commission’s proposed AML Package (AML Regulation, AMLD6, AMLA Regulation, Recast FTR)

The European Banking Federation (EBF) is fully supportive of the Commission’s overarching objective to address the ineffectiveness of the current EU AML framework. Bearing in mind the necessary lead-time and efforts to get the AML Package adopted and implemented, this momentum is a unique opportunity to improve the framework.

According to the EBF, a paradigm shift is needed. This consists in moving away from the existing legalistic and bureaucratic tick-the-box approach which generates massive flows of irrelevant data that Financial Intelligence Units cannot exploit in an efficient manner. Some of the steps proposed in the package are going in the right direction, notably by addressing the existing regulatory and supervisory fragmentation, as well as extending transparency requirements to crypto-assets and crypto-asset service providers.

While the standardisation of key customer identity information for KYC purposes and beneficial ownership information introduced with the proposed AML Regulation is a positive move, the approach is too prescriptive, and the discretion left to the Member States in adopting additional measures may lead to gold-plating, reintroducing fragmentation. Besides, the proposed AMLD6 maintains the status quo about Beneficial Owner (UBO) registers. In the EBF’s view, UBO registers need to be not only harmonised and interlinked, but also significantly strengthened.

The set-up of a new EU AML Authority (AMLA) is a crucial component of this package. It is hence of great importance that it brings true value to the effective fight against financial crime and does not simply introduce another layer of ex-post reporting.

The EBF maintains that it is key to develop an intelligence-led approach to effectively mitigate money laundering risks and detect financial crime. However, the package does not address some fundamental dimensions of information sharing which must leverage new technologies and involve all actors of the AML framework, including law enforcement and public-private partnerships.

For more information:

Roger Kaiser, Senior Policy Adviser – Fiscal & Anti-Money Laundering, R.Kaiser@ebf.eu

Eduard Hovsepyan, Policy Adviser – Anti-Money Laundering, e.hovsepyan@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere. Website: www.ebf.eu Twitter: @EBFeu.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF feedback to the European Commission’s proposed AML Package appeared first on EBF.

]]>EBF Response to Public Consultation on Guidance on the Rules Applicable to the Use of Public-Private Partnerships in The Framework of Preventing and Fighting Money Laundering and Terrorist Financing

EBF Response to Public Consultation on Guidance on the Rules Applicable to the Use of Public-Private Partnerships in The Framework of Preventing and Fighting Money Laundering and Terrorist Financing

x

Brussels, 10 January 2022 – The EBF has responded to the Commission consultation on guidance on rules for Public-Private Partnerships in the AML/CFT domain.

The EBF stresses that information sharing in the context of fighting financial crime is critical in ensuring the effectiveness of the AML/CFT rules. Weaknesses in information sharing between obliged entities, financial intelligence units and law enforcement authorities may inadvertently facilitate the activities of criminals who operate nationally or across borders.

At present, obliged entities send large numbers of SARs to FIUs with no or insufficient quantitative feedback. This situation does not allow obliged entities to focus on the most relevant predicate offenses and leads to an increased number of false positives. Often finding the relevant information for law enforcement authorities may feel like finding a needle in a haystack. If an intelligence-led approach were applied in the AML/CFT framework, obliged entities could receive information on current trends and typologies, as well as operational data which would allow them to focus their efforts on priorities as defined by law enforcement authorities. As a result, obliged entities would be able to send back more actionable data and do it in a smarter and aligned with data minimisation requirements way, reporting information when truly necessary.

The complex nature of money laundering and terrorism financing, often involving cross-border flows of funds and the involvement of many layers of entities, makes it challenging to detect such crimes when the data available to do so is mainly limited to a regulated entity’s own customer base and available open-source intelligence. Being able to enrich this view with information from other private sector entities and competent authorities enhances the likelihood of effective detection for all parties involved in a public-private partnership. It also allows both obliged entities and public authorities to form a holistic overall view of the current trends.

x

For more information:

Roger Kaiser, Senior Policy Adviser – Fiscal & Anti-Money Laundering, R.Kaiser@ebf.eu

Eduard Hovsepyan, Policy Adviser – Anti-Money Laundering, e.hovsepyan@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF Response to Public Consultation on Guidance on the Rules Applicable to the Use of Public-Private Partnerships in The Framework of Preventing and Fighting Money Laundering and Terrorist Financing appeared first on EBF.

]]>EBF supports EU’s latest efforts in fight against financial crime

EBF PRESS RELEASE

h

EBF supports EU’s latest efforts in fight against financial crime

BRUSSELS, 20 July 2021 – The European Banking Federation (EBF) today expressed support for the objectives of the European Commission’s Anti-Money Laundering and Countering the Financing of Terrorism Package which aims to strengthen the fight against financial crime in Europe. The banking industry representative also emphasised the need for some specifications to be laid down to ensure that the new EU AML Authority plays a useful role in preserving the integrity of the European Union’s financial system and the security of its citizens.

The EBF is pleased to learn that the recommendations outlined in its AML Blueprint have to a large extent been taken into consideration by the European Commission, demonstrating a common view on key topics. Regulatory harmonisation and enhanced coordination of Financial Intelligence Units proposed in the package will create synergies, facilitating the work of law enforcement and competent authorities. With the harmonisation of customer due diligence rules proposed by the Commission, multinational banking groups will be able to develop more consistent group-wide policies and processes. A clear cut between the AML Directive and the AML Regulation included in the package will be necessary to avoid any duplication of obligations under both legal instruments, as well as gold plating by the Member States and new divergences across the EU.

The set-up of the new EU AML Authority will be critical. For the new Authority to bring value, it must facilitate information exchange and help detect cross-border criminal activities. Properly calibrating the scope and competencies of direct supervision of selected entities will be crucial. The agency should also avoid overlaps and duplications with national supervisors as well as ensure coverage of the non-financial sector. The selection of supervised entities should follow a risk-based approach rather than focusing on the size of entities. It is essential to note that the largest entities are not always the ones carrying the largest AML/CFT risk. Adequate staffing and funding of the new authority will likewise be important. However, the duplication of banking levies should be avoided. Contributions should also be requested from other regulated financial and non-financial businesses and professions.

It is crucial to ensure that today’s package is followed by appropriate actions to enable information sharing, fostering Public-Private Partnerships and supporting the wider use of machine learning and AI technologies in the AML/CFT space, including the setting up of data sharing utilities. Personal data protection rules are often interpreted too restrictively and must be re-calibrated to ensure more balanced interactions between the AML/CFT framework and the GPDR.

“The success of the Package will now depend on the ability of the Parliament and the Council to translate the proposals into a much more effective AML/CFT framework, clarifying the grey zones in the rulebook and supporting effective cross-border cooperation, information sharing and public-private partnerships,” says Wim Mijs, CEO of EBF. “For the EU AML Authority to effectively contribute to the fight against financial crime, it must make information exchange easier and help detect cross-border criminal activities. It is important to stress that this objective cannot be achieved by simply introducing another layer of ex-post reporting,” he added.

European banks are committed to the fight against money laundering and terrorism financing. Public and private stakeholders must continue to build trust and work hand in hand. The EBF remains at the forefront of this fight and stands ready to provide input on the proposed Directive and Regulations and advice that are necessary to get them right.

For more information:

Ruta Barthet, Senior Media and Communications Officer

r.barthet@ebf.eu

x

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere. Website: www.ebf.eu Twitter: @EBFeu.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF supports EU’s latest efforts in fight against financial crime appeared first on EBF.

]]>Banking Essentials Webinar

Navigating AML Compliance: Opportunities & Challenges

18 February

DATE & LOCATION

Tuesday, 18 February 2020

15:30 CET / 14:30 GMT

ONLINE

Fragmented AML systems and platforms make it hard for banking institutions to keep financial crime at bay. Financial institutions continue to spend heavily on AML compliance to deal with the curse of dirty money but advancements in payment processing technology, increased level of organized crime, and expansion of economic sanctions have continued to erode the effectiveness and efficiency of AML programs. Can technology beat financial crime? Machine learning, real-time data-aggregation, artificial intelligence, and speech/text recognition analytics can approach compliance in a fundamentally new way, but also regulatory action is instrumental.

In this first BANKING ESSENTIALS webinar, produced jointly by S&P Global Market Intelligence and the European Banking Federation, two industry experts shared their thoughts on the challenges and opportunities within the AML compliance space.

WATCH THE FULL WEBINAR

SPEAKERS

Salman Khan

Head of Commercial Bank Product, EMEA, S&P Global Market Intelligence

Salman Khan heads the Commercial Banking Product Segment for EMEA. Salman focuses on uncovering new trends in the banking sector and their potential impact on the business with the goal of developing products that help banks solve critical business challenges across various operating segments including commercial lending, risk management and corporate strategy.

Previously, Salman was working as a Banks Equity Strategist at HSBC covering global investment and wholesale banks, where he analysed banking sector trends across developed and emerging markets and proposed investment strategies to fund and portfolio managers. Salman has over 9 years of experience working within the financial institutions sector in various product, research and commercial roles.

Roger Kaiser

Roger Kaiser

Senior Policy Adviser – Fiscal & Anti-Money Laundering

Roger Kaiser has 25 years of experience in taxation and financial reporting and a robust expertise in international public affairs. He is a member of the Belgian Institute of Chartered Accountants and Tax Advisers and has served the Belgian Internal Revenue Service for 7 years, notably as Head of the Taxation Unit for Brussels’ financial intermediaries and as Head Inspector at the Ruling Commission and the Directorate General for Corporate Income Tax & Withholding Tax. In 1999, he joined the European Banking Federation, the representative body of Europe’s banks. In his capacity as Senior Policy Adviser for taxation and financial crime, he represents European banks in a number of international expert groups run under the aegis of the OECD, EU Institutions and industry representation bodies. He is also Lecturer in the Master of Advanced Studies in International Taxation at the University of Lausanne.

Moderated by

Steve Matthewson, Senior News Desk Manager, S&P Global Market Intelligence

Raymond Frenken, Director of Communications, European Banking Federation

ABOUT S&P Global Market Intelligence

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that help track performance, assess credit risk, understand competitive and industry dynamics, generate alpha, identify investment ideas, and perform valuation. S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). For more information, visit www.spglobal.com/marketintelligence. Twitter handle: @SPGMarketIntel

ABOUT the European Banking Federation

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from 45 countries. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere.

The post Banking Essentials Webinar – Navigating Complexity: Opportunities & Challenges appeared first on EBF.

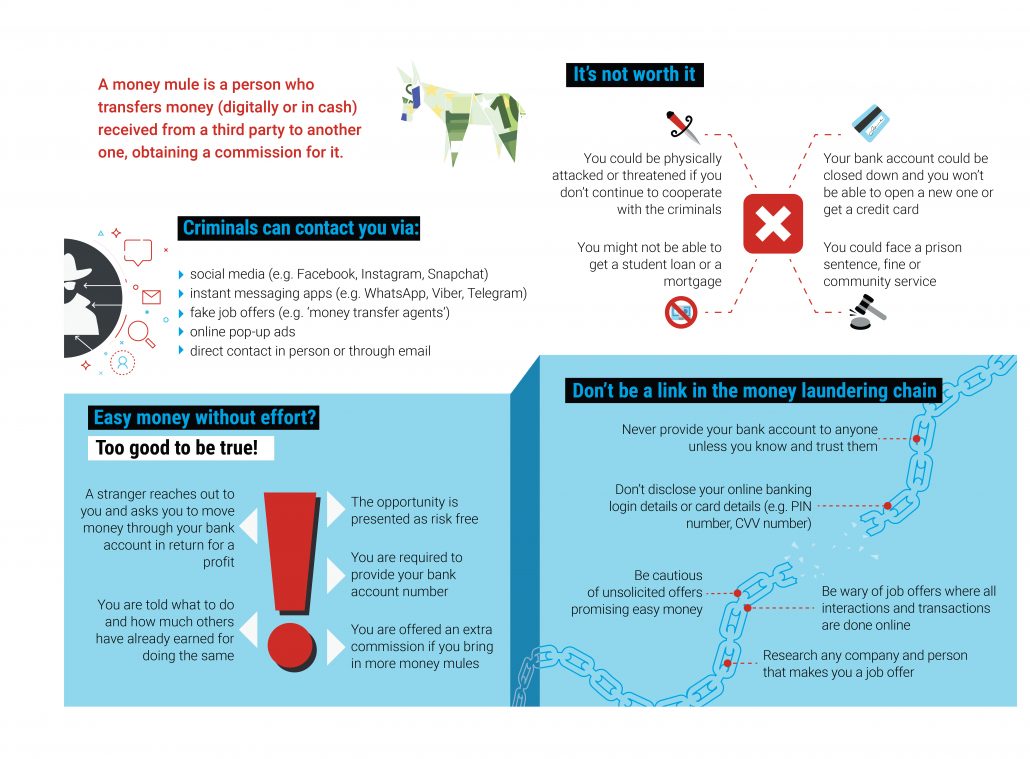

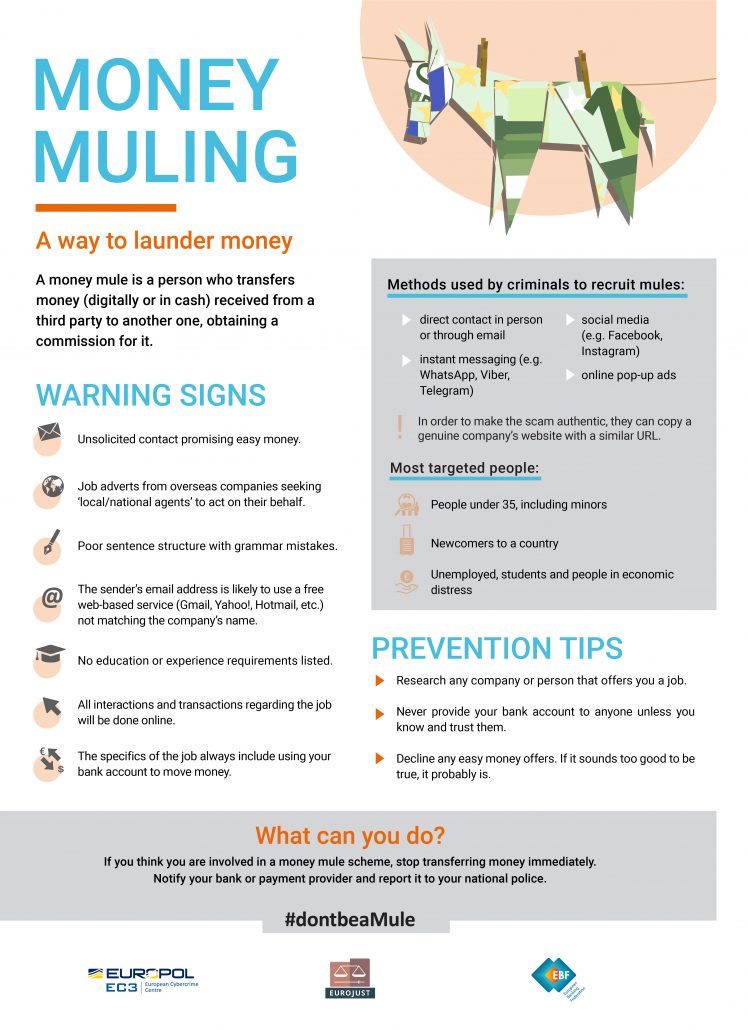

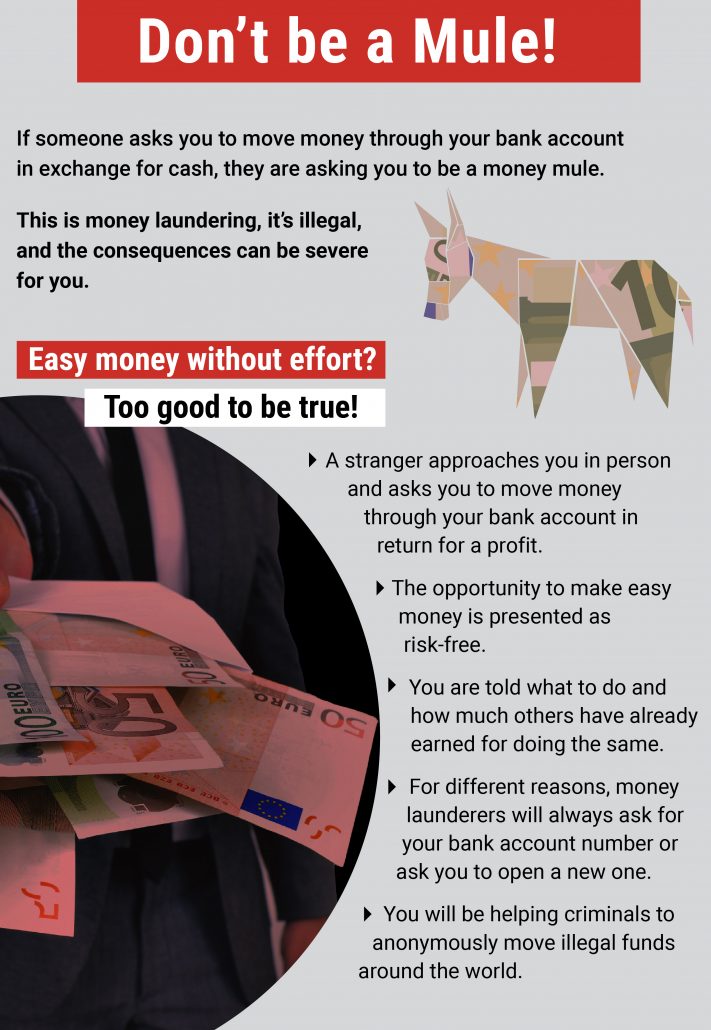

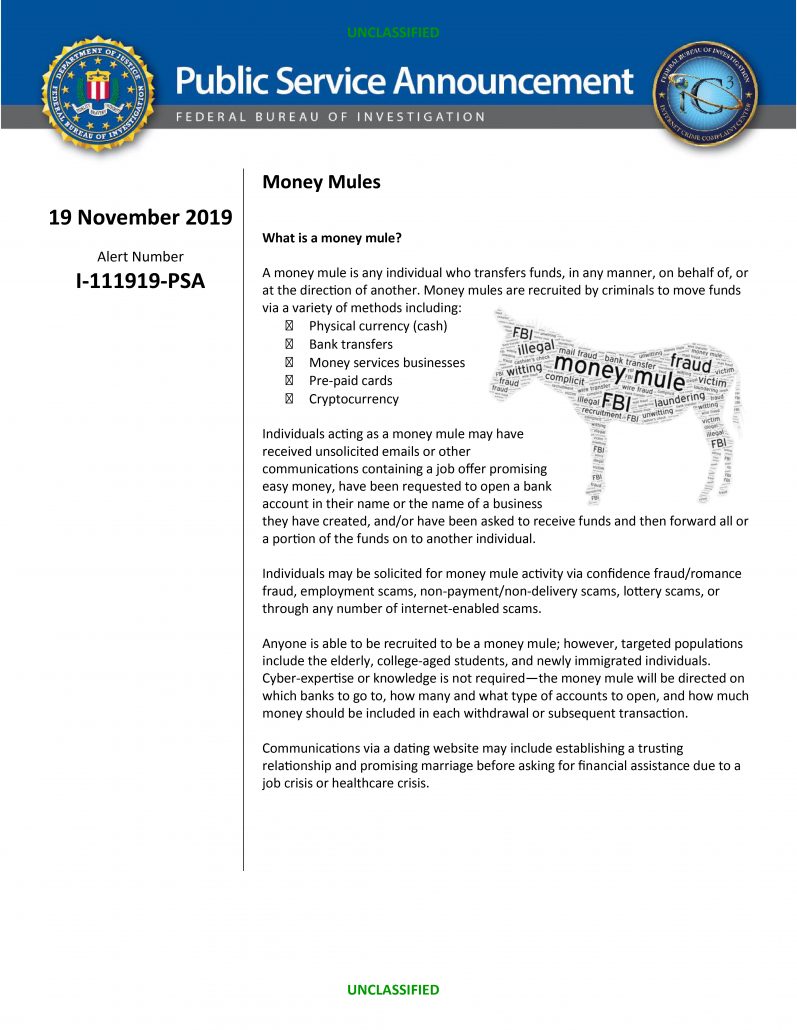

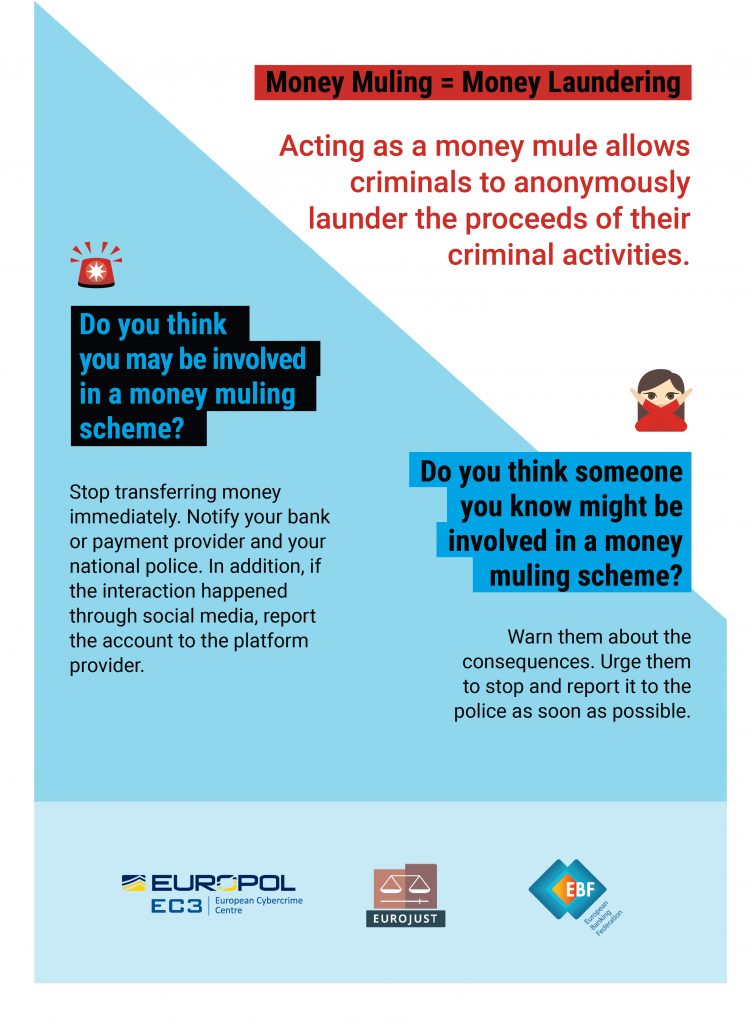

]]>Do not help money laundering criminals #DontbeAMule

The awareness material is freely shareable and available in 25 languages. Download the Money Mule posters and flyers in your language (PDF)

Posters

EU: Austria – DE | Australia – EN | Belgium – FR NL | Bulgaria – BG | Croatia – HR | Czech Republic – CS |Denmark – DA | Estonia – ET | Finland – FI | France – FR | Germany – DE | Greece – EL | Hungary – HU | Ireland – EN | Italy – IT | Latvia – LV | Malta – MT | Moldova – RO | Netherlands – NL |Norway – NO | Poland – PL | Portugal – PT | Romania – RO | Serbia RS | Slovenia – SL | Spain – ES | Sweden – SV | Switzerland – DE FR IT | United Kingdom – EN | Ukraine – UKR

Flyers

EU: Austria – DE | Australia – EN | Belgium – FR NL | Bulgaria – BG | Croatia – HR | Czech Republic – CS |Denmark – DA | Estonia – ET | Finland – FI | France – FR | Germany – DE | Greece – EL | Hungary – HU | Ireland – EN | Italy – IT | Latvia – LV | Malta – MT | Moldova – RO | Netherlands – NL |Norway – NO | Poland – PL | Portugal – PT | Romania – RO | Serbia – RS | Slovenia – SL | Spain – ES | Sweden – SV | Switzerland – FR IT DE | United Kingdom – EN | Ukraine – UKR

WHAT IS MONEY MULING?

- A money mule is a person who transfers illegally obtained money between different payment accounts, very often in different countries, on behalf of others.

- Money mules are also recruited by criminals to receive money into their bank account, in order to withdraw the money and in most cases wire it overseas, receiving a commission payment in return for the provided services.

- Even if money mules are not involved in the crimes which generate the money (cybercrime, payment and on-line fraud, drugs and human trafficking, etc.), they are acting illegally by laundering the proceeds of crime, helping criminal syndicates move funds easily around the world and remain anonymous..

- If you are caught acting as a money mule, even if done so unwittingly, you can face a prison sentence, fine or community service, and the prospect of never again being able to secure a mortgage or open a bank account.

HOW ARE MONEY MULES RECRUITED?

As new technologies and trends emerge, organised crime groups develop new systems to defraud people:

- seemingly legitimate job adverts (e.g.: ‘money transfer agents’)

- seemingly legitimate online posts

- direct approach in person or through email

- social media (i.e. Facebook posts on closed groups)

- messages sent through instant messaging apps (e.g.: Whatsapp, Viber)

WHO ARE THE MOST TARGETED INDIVIDUALS?

- Newcomers to the country (often targeted soon after arrival) as well as the unemployed, students and people in economic distress are the most susceptible to the crime.

- Men are more likely than women to be targeted to become a mule, as are those aged 18-34 years compared to people aged 55+.

WHAT ARE THE WARNING SIGNS?

The following characteristics do not necessarily indicate a money mule solicitation, but they are commonly used in those solicitations:

- Money mule adverts or offers may copy a genuine company’s website and have a similar web address to make the scam seem authentic.

- If done by email, the writing is often awkward and includes poor sentence structure with grammatical and spelling mistakes. The email address associated with the offer uses a web-based service (Gmail, Yahoo!, Windows Live Hotmail, etc.) instead of an organisation-based domain.

- These adverts will normally state that they are an overseas company seeking ‘local/national representatives’ or ‘agents’ to act on their behalf for a period of time, sometimes to avoid high transaction charges or local taxes.

- The position involves transferring money or goods.

- The specific job duties are not described.

- The position does not list education or experience requirements.

- All interactions and transactions will be done online. The offer promises significant earning potential for little effort.

- The nature of the work that the company will claim to be involved in can vary, but the specifics of the job being advertised invariably mean using your bank account to move money.

HOW TO PROTECT ONESELF?

- If an opportunity sounds too good to be true, it probably is.

- Be very cautious of unsolicited emails or approaches over social media promising opportunities to make easy money.

- Verify any company that makes you a job offer and check their contact details (address, landline phone number, email address and website) are correct and whether they are registered in your country.

- Be especially wary of job offers from people or companies overseas as it will be harder for you to find out if they really are legitimate.

- Never give your bank account or any other personal details to anyone unless you know and trust them.

- Look for the common warning signs as above explained, and do some research before agreeing to participate.

WHAT TO DO?

- If you have received e-mails of this type do not respond to them and do not click on any links they contain. Inform the police instead.

- If after reading this flyer you believe that you are participating in a money mule scheme, stop transferring money immediately and notify your bank, the service you used to conduct the transaction, and law enforcement.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post Do not help money laundering criminals #DontbeAMule appeared first on EBF.

]]>422 arrested and 4,031 money mules identified in global crackdown on money laundering

JOINT PRESS RELEASE

b

422 arrested and 4,031 money mules identified in global crackdown on money laundering

- 422 arrested and 4,031 money mules identified in global crackdown on money laundering

- EBF partners with Europol, FinTech FinCrime Exchange, INTERPOL and Western Union in European Money Muling Action

BRUSSELS/THE HAGUE, 2 December 2020 – Today, law enforcement authorities from 26 countries and Europol announce the results of the European Money Mule Action ‘EMMA 6’, a worldwide operation against money mule schemes. Between September and November 2020, EMMA 6 was carried out for the sixth consecutive year with the support of the European Banking Federation (EBF), FinTech FinCrime Exchange, INTERPOL and Western Union. As a result, 4,031 money mules were identified alongside 227 money mule recruiters, and 422 individuals were arrested worldwide.

During the span of the operation, 1,529 criminal investigations were initiated. With the support of the private sector including more than 500 banks and financial institutions, 4,942 fraudulent money mule transactions were identified, preventing a total loss estimated at €33.5 million.

The European Banking Federation, together with member bank associations across Europe supported the action for the fifth time.

Don’t become a link in the money laundering chain

Money mules are individuals who, often unwittingly, have been recruited by criminal organisations as money laundering agents to hide the origin of ill-gotten money. Unaware that they are engaging in criminal activities, and tricked by the promise of easy money, mules transfer stolen funds between accounts, often in different countries, on behalf of others. In exchange, they receive a commission for their services.

While mules are recruited via numerous routes such as direct contact or through email, criminals are more and more turning to social media to recruit new accomplices, through the advertisement of fake jobs offers (e.g. ‘money transfer agents’), online pop-up ads and instant messaging applications. Although some COVID-19 related cases have been reported, payment process compromise and romance scams continue to be the most recurrent schemes. The use of cryptocurrencies by money mules is also on the rise.

This week, Europol and EU law enforcement authorities together with international partners and financial institutions will launch the #DontBeaMule campaign to raise awareness among the public on the risks of money mule schemes.

The campaign, promoted nationally by competent authorities, will aim to inform the public about how criminals operate, how they can protect themselves and what to do if they become involved.

What do you risk as a money mule?

- physical attacks or threats if you don’t continue to cooperate with the criminals;

- prison sentence, fine or community service;

- a criminal record that could seriously affect the rest of your life such as never being able to secure a mortgage or open a bank account.

What can you do?

If you think you might be used as a mule, act now before it is too late: stop transferring money and notify your bank and your national police immediately.

Europol support

Operation EMMA is part of an ongoing project conducted under the umbrella of the EMPACT Cybercrime Payment Fraud Operational Action Plan, designed to combat online and payment card fraud, led by the Netherlands. Building on the success of the previous EMMA operations, EMMA 6 saw the participation of law enforcement authorities from Australia, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Estonia, Finland, Greece, Hungary, Ireland, Italy, Lithuania, Moldova, Netherlands, Poland, Portugal, Romania, Spain, Sweden, Switzerland, Slovenia, Slovakia, United Kingdom and United States.

During this yearlong operation, Europol supported the coordination and preparation of operational meetings, delivered analysis and facilitated the exchange of information between law enforcement authorities and private partners. Furthermore, Europol coordinated the awareness campaign with the participating countries.

Headquartered in The Hague, the Netherlands, Europol supports the 27 EU Member States in their fight against terrorism, cybercrime and other serious and organised forms of crime. We also work with many non-EU partner states and international organisations. From its various threat assessments to its intelligence-gathering and operational activities, Europol has the tools and resources it needs to do its part in making Europe safer.

x

Follow the EMMA prevention campaign here via social media:

Europol and EC3 Twitter, Facebook, Instagram, Youtube and LinkedIn

EBF Twitter, Facebook and Linkedin

s

Media contact:

EBF Media Centre, press@ebf.eu, +32 2 508 3732

About the EBF:

The European Banking Federation is the voice of the European banking sector, bringing together national banking associations from across Europe. The EBF is committed to a thriving European economy that is underpinned by a stable, secure and inclusive financial ecosystem, and to a flourishing society where financing is available to fund the dreams of citizens, businesses and innovators everywhere. Website: www.ebf.eu

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post 422 arrested and 4,031 money mules identified in global crackdown on money laundering appeared first on EBF.

]]>