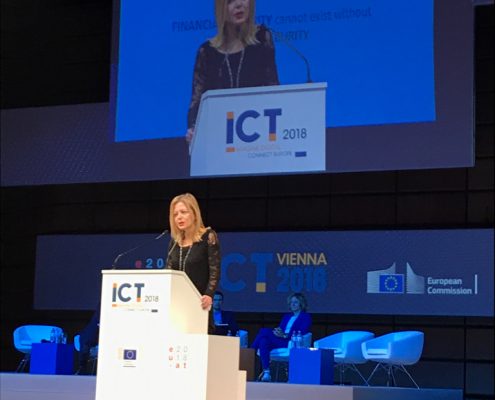

EBF’s Senior Policy Adviser on Cybersecurity Alexandra Maniati participated at ICT2018, discussing in a plenary panel on “Cybersecurity as key for the digital economy and society” and speaking on cybersecurity in the European banking sector. The panel also focused on the strategic areas where the EU needs to invest to reinforce its cybersecurity and thus protect its economy and society: research, innovation and industrial capabilities.

ICT 2018 took place in Vienna on 4-6 December 2018, organized by the European Commission and the Austrian Presidency of the Council of the EU as an open and broad event where citizens joined science community members, policymakers, industry and ICT-enthusiasts to discuss the future in a digital Europe. This research and innovation event attracted 4,800 visitors and focused on the European Union’s priorities in the digital transformation of society and industry. It presented an opportunity for the people involved in this transformation to share their experience and vision of Europe in the digital age.

Alexandra’s key points included:

Three key challenges re cybersecurity in the banking sector

- Manage cyber risks related to an increasingly complex, interconnected and growing chain of actors;

- Ensure harmonized, consistent and adequate regulation and supervision for all links within this complex chain for better cyber resilience and customer protection;

- Educate, find and retain cyber-skilled employees, and help customers become aware of cyber risks.

Cybersecurity is a shared responsibility

It is necessary for the public and private sectors to work together, across borders, mainly on three levels:

- Continuous and consistent raising of awareness on risks and cyber hygiene for customers, up-skilling and re-training existing workforce, reviewing formal education curricula to shape the future workforce;

- Identification of needs of industry and consumers, and provision of better solutions through a close cooperation between private sector and EU agencies like ENISA and the upcoming European Cybersecurity Industrial, Technology & Research Competence Centre;

- EU-level trusted platforms for the exchange of actionable information to better prevent attacks and more effectively mitigate them when they occur.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post Cybersecurity as key for a Digital Economy and Society: EBF at ICT 2018, Vienna appeared first on EBF.

]]>EBF co-signs letter on EU cybersecurity certification proposal

Cross-industry and standards development organisations open letter on the EU Cybersecurity certification framework proposal

BRUSSELS, 25 June 2018 – Our associations represent more than 56 000 companies in Europe in key areas for jobs and economic development in Europe.

Ahead of the expected vote on 10 July in the European Parliament’s Industry, Research and Energy (ITRE) committee, we urge European decision-makers to ensure that the EU cybersecurity certification framework will not be detrimental to the competitiveness of the EU industry and will rather support a flexible and future-proof framework. The Cybersecurity Act aims to harmonise the Single Market and contribute to the establishment of the Digital Single Market, increase cybersecurity in Europe and turn the EU cybersecurity certification schemes into a competitive advantage for the industry and a globally-recognised instrument.

Our associations have, however, a number of recommendations as regards ongoing political discussions, and therefore call on the European Parliament to consider with specific attention the five following points:

1. The voluntary approach to certification is key for it to remain a competitive advantage for the industry and avoid unintended consequences both on smaller market actors and on already heavily regulated sectors. We therefore recommend keeping the voluntary nature of the certification framework, possibly to be reviewed at a later stage, according to the evolution of the cybersecurity landscape. To avoid potential Single Market fragmentation, it is key to avoid a situation, where national legislation can mandate a scheme.

2. Conformity assessment methods and requirements should be defined in the schemes and not in the regulation itself so as to allow for a fit-for-purpose approach according to risks and use cases. Allowing for self-declaration of conformity is fundamental to streamline the certification process and make it accessible to all market actors.

3. A clear framework for the participation of the industry should be defined, to make sure ENISA collaborates openly with the industry when preparing, elaborating and adopting candidate schemes. We support the proposal of the European Parliament to set specific ad-hoc consultation platforms but to occur on a systematic basis with formal rules to ensure a level playing field for stakeholders’ representation. A positive step to this direction can also be the proposal for the establishment of a “Stakeholder Certification Group”.

4. The adoption of the schemes should include a process to ensure that they are aligned or could take part in existing international mutual recognition agreements to ensure that the EU certificates are globally recognised.

5. Reference to global standards should prevail. This includes European Standards, International Standards, and Technical Specifications, that have been developed in accordance with defined principles in EU standardisation legislation (i.e. Annex II of Regulation EU 1025/2012), developed in an inclusive and transparent way. Allowing for any deviation from this principle creates uncertainty for market players and would need to be clarified.

About AFME

AFME (Association for Financial Markets in Europe) advocates for deep and integrated European capital markets which serve the needs of companies and investors, supporting economic growth and benefiting society. AFME is the voice of all Europe’s wholesale financial markets, providing expertise across a broad range of regulatory and capital markets issues. AFME aims to act as a bridge between market participants and policy makers across Europe, drawing on its strong and long-standing relationships, its technical knowledge and fact-based work. Its members comprise pan-EU and global banks as well as key regional banks, brokers, law firms, investors and other financial market participants. AFME participates in a global alliance with the Securities Industry and Financial Markets Association (SIFMA) in the US, and the Asia Securities Industry and Financial Markets Association (ASIFMA) through the GFMA (Global Financial Markets Association). For more information please visit the AFME website: www.afme.eu. Follow us on Twitter @AFME_EU

About Agoria

Agoria brings together and defends the interests of companies in the technology industry. The federation is committed to the future of these companies and the nearly 275,000 people they employ. With 1,900 member companies, Agoria is the largest sectoral employers’ federation in Belgium.

About APPLiA

APPLiA is a Brussels-based trade association that provides a single, consensual voice for the home appliance industry in Europe. It promotes the industry’s general mission to increase product innovation while reducing the environmental impact of appliances. APPLiA members produce the following type of appliances: •Large appliances such as refrigerators, freezers, ovens, dishwashers, washing machines and dryers;

• Small appliances such as vacuum cleaners, irons, toasters and toothbrushes; • Heating, ventilation and air conditioning appliances such as air conditioners, heat pumps and local space heaters.

The home appliance industry is an important European economic player. – Generating wealth: the total annual turnover of the industry in Europe is €47.6bn (2016) – Providing good employment: – Total employment as a result of the presence of the sector: approximately 889.192 jobs, – Direct employment: 202.089 jobs – investment in the future: €1.4bn contribution to research and development activities in Europe.

About Danish Chamber of Commerce

The Danish Chamber of Commerce is the network for the service industry in Denmark. It is one of the largest professional business organisations in Denmark with

more than 200 employees, offices in Copenhagen, Aarhus and in Brussels. The Chamber represents 17,000 Danish companies and 100 trade associations within

trade, tourism, business services, IT, welfare services and transportation.

About DIGITALEUROPE

DIGITALEUROPE represents the digital technology industry in Europe. Our members include some of the world’s largest IT, telecoms and consumer electronics companies and national associations from every part of Europe. DIGITALEUROPE wants European businesses and citizens to benefit fully from digital technologies and for Europe to grow, attract and sustain the world’s best digital technology companies. DIGITALEUROPE ensures industry participation in the development and implementation of EU policies.

DIGITALEUROPE’s members include in total over 35,000 ICT Companies in Europe represented by over 63 Corporate Members and 39 National Trade Associations from across Europe. Our website provides further information on our recent news and activities: http://www.digitaleurope.org

About EBF

The European Banking Federation is the voice of the European banking sector, uniting 32 national banking associations in Europe that together represent some 3,500 banks – large and small, wholesale and retail, local and international – employing about 2.1 million people. EBF members represent banks that make available loans to the European economy in excess of €20 trillion and that securely handle more than 300 million payment transactions per day. Launched in 1960, the EBF is committed to creating a single market for financial services in the European Union and to supporting policies that foster economic growth. www.ebf.eu @EBFeu

About OpenForum Europe

OpenForum Europe (OFE) is a not-for-profit, independent European based think tank which focuses on openness within the IT sector. We draw our support not only from some of the most influential global industry players, but most importantly from across European SMEs and consumer organisations and the open community. OFE also hosts a global network of OpenForum Academy Fellows, each contributing significant innovative thought leadership on core topics. Views expressed by OFE do not necessarily reflect those held by all its supporters.

About Syntec Numerique

Syntec Numérique is the first professional organization within the French digital ecosystem with more than 2000 members ranging from large corporations to start-ups. Its members span software industry, engineering, technology consulting or operations, and their business cover the full spectrum of digital sector from data economy to cybersecurity, IoT, mobility or ehealth.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF co-signs letter on EU cybersecurity certification proposal appeared first on EBF.

]]>EU Digital Finance Strategy: EBF responds to EC consultation

EU Digital Finance Strategy: EBF responds to EC consultation

k

Publication date: 1 July 2020

The European Banking Federation has submitted its response to the European Commission consultation on an EU Digital Finance Strategy. Click here for the contribution submitted by EBF.

The EBF welcomes the European Commission’s initiative to present a new Digital Finance Strategy this year and its commitment to support the development of digital finance in the EU. This is crucial in the view of European banks, who continue their work to ensure a secure digital transformation of financial services, shaping new business processes and delivering on client expectations in a digital economy.

The EBF supports the four priority areas identified by the Commission for policy action:

- ensuring a technology-neutral and innovation-friendly EU financial services framework;

- realizing the opportunities offered by the EU Single market for digital finance services addressed to consumers and firms;

- promoting a data-driven financial sector;

- enhancing its operational resilience.

In this context, we stress that ensuring a level playing field must be a key objective of a technology-neutral, innovation-friendly policy approach. Only by ensuring fair competition among all actors can the EU maximize the benefits of digitalisation in finance. We therefore firmly support the Commission’s commitment to the principle of “same activity that creates the same risks should be regulated in the same way” and recommend that the Commission promotes innovation by all actors under fair and even conditions, including in areas such as access to technical infrastructure outside of the traditional financial sector.

The challenges that still exist in the functioning of the Single Market and the lack of effective harmonization in rules, supervision and enforcement are key obstacles to the ability of banks to fully develop their potential and successfully compete in the digitalised environment. The EBF strongly supports the Commission’s aim to remove fragmentation in the Single Market for digital financial services, and underlines that cross-border coordination within the EU and globally is fundamental, particularly as digitalisation increases the cross-border provision of financial services. Fragmentation also impacts the ability of financial service providers to leverage new technologies, such as cloud computing, AI, and blockchain, which can help both in boosting efficiency and in delivering improved services for consumers.

The EBF welcomes the Commission’s ambition to promote a data-driven financial sector as part of its overall goal to build a EU data economy, as set out in the EU Data Strategy. However, we would like to emphasise that initiatives to increase data sharing should not focus on financial services where this has been done already through previous legislation. Valuable opportunities for data-driven innovation for consumers and firms will come from reusing and combining data across sectors. We therefore encourage the creation of a cross-sectoral data sharing framework, which puts users – individuals and firms – in the centre.

Finally, financial literacy and financial education are vital in helping empower consumers so that they are able to fully take advantage of the opportunities of digital financial services, and contribute to en effective consumer protection. The EBF strongly supports further actions to boost financial literacy and education across the EU, with the participation of a broad range of stakeholders.

k

CONTACT:

Liga Semane, Policy Adviser, Data & Innovation, l.semane@ebf.eu

Alexandra Maniati, Director, Cybersecurity & Innovation, a.maniati@ebf.eu

MEDIA CONTACT:

Nahuel Mercedes, Communications Officer, n.mercedes@ebf.eu

k

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EU Digital Finance Strategy: EBF responds to EC consultation appeared first on EBF.

]]>4th SSM & EBF Boardroom Dialogue

Thursday 7 March, Frankfurt

Introduction by Wim Mijs, CEO of the European Banking Federation

.

Frankfurt, 07 March 2019

.

AS PREPARED FOR DELIVERY

Welcome everyone to the 4th EBF SSM Boardroom Dialogue.

I would like to thank Marcus Chromik, for your hospitality once again hosting this landmark event for the European banking industry in this magnificent venue of Commerzbank.

Introduction by Wim Mijs, Chief Executive Officer of the European Banking Federation

I am impressed by the interest that this initiative has sparked off in the banking system with more than 100 senior representatives from significant institutions, including many Chief Executives, Board Members, Chief Financial Officers, Chief Risk Officers and, interestingly, this year we have various Chief Information Security Officers.

For me , this clearly indicates to me that all managers in the banking system, from banks and from regulators and supervisors, need this communication in order to face up to the extremely challenging environment ahead of us, both from the private sector and the public sector. Let’s not forget that we are all in the same boat.

The SSM and the EBF alike have evolved tremendously to adapt to the new banking landscape in the last 4 years. But one can never stay quiet in a rapidly changing environment. Not only Financial Stability is an objective of today’s banking sector, but also understanding rapidly changing customer preferences, adapting to the challenge of digital transformation and doing all this in a low-interest rate environment. These are significant challenges for the banking system in the next years to secure their primary role as providers of funding to the economy.

We at the EBF are preparing our vision for the next 4-year term along these lines:

- Achieving a stable and efficient regulatory and supervisory framework;

- Resetting and revice and reenergize the Capital Markets Union;

- Achieving the Digital Single Market in which our banks can compete;

- Restoring confidence in our banking system for which purpose, we work on two concrete objectives:

– Making banks responsible partners;

– Investing in financial education.

All this will happen as we continue working in the building of the Banking Union, a project in which we believed from the start and that the EBF has always supported. Not only supported but actively contributed to its successful implementation. And the proof of the pudding is that we have all come together in this room to discuss about what lies ahead for the SSM and the banks under its supervision and how we deal with eachother.

Our commitment to the European vision of the banking sector is demonstrated by the opening of our Frankfurt office, opened almost immediately at the start of the SSM, and our close collaboration with the SSM management even before the takeover of supervisory responsibilities from the National Supervisors in 2014. Since then, the EBF team and the banks we represent have held more than 70 meetings and events with the participation of more than 15 hundred bankers throughout.

So a lot of meaningful communication has been exchanged in our Frankfurt office and elsehwere by the actors of this unique endeavour of the transition towards a Single Supervisor.

Let me bring to your memory some outstanding examples of mutual collaboration between EBF and SSM:

- I have personally very fond memories of 2014, even before the takeover of supervisory responsibilities from the National Supervisors, we worked together with the ECB during the Asset Quality Review. We examined together the thorough templates and worked them out to ensure that banks’ feedback would be feasible and of a sufficient quality. That was a success because we engaged with the senior experts from our SSM Strategy Group in Frankfurt.

- Another example was the evaluation of the SSM implementation. We turned our roles for a change and became the evaluators of the supervisor, a unique role which we very much liked I must say. We examined the way that the new supervisory practices were being implemented and prepared a report with recommendations for improvement. I realised that the SSM management is determined to make the SSM a success when we witnessed how seriously the SSM, then led by Daniele Nouy, took our feedback. We have improved since then, but this is a continuous process. It’s impressive to have a supervisor who engages with the industry.

- Another case of mutual collaboration is the Bank Integrated Reporting Dictionary, known as the BIRD project, where the EBF banks and the ECB have been working together during the last 2 years in the definition of a taxonomy that will help making reporting more efficient.

At the same time, we have maintained a close relationship with the European Banking Authority during the previous mandate of Andrea Enria. Let me put some examples as well:

- In the context of the SREP Guidelines, we held numerous meetings to assist with the banks’ expertise, including discussions on topics as sensitive as the threshold for Maximum Distributable Amounts. This was a very delicate question that shows the importance of fluent communication between regulators, banks and supervisors. The question was later discussed in our CEO Roundtable at the SSM, closing the circle from regulation to supervision.

- One more example is the collaboration with the EBA department of Analysis, under the direction of Piers Haben, present today with us. Stress testing is a complex process – we all know – sometimes overcomplicated and not very well understood, but the openness of the EBA to discuss about the methodological issues and to cooperate in the communication of results is essential for restoring confidence in our sector. Again that is another good example of working closely together.

- My last example is about reporting. The EBF teams have collaborated during long years with the EBA in the definition of the CoRep and FinRep. However, the reporting needs have increased due to new regulations and the enhanced level of integration. The EBA has been given a mandate in the new Capital Requirements Regulation just agreed in Brussels, to define a common reporting hub. We look forward to continue cooperating with the EBA and with the ECB to ensure the efficiency of the new reporting framework, leveraging as much as possible on the work done in the context of the BIRD project.

Today marks a new step in this longstanding relationship. And if we look at the program, we see that you will be discussing today the issues affecting the banking system these days. It looks like a fruitful and interesting day.

Firstly, we will have the privilege to listen to the keynote speech of the new SSM Chair, Andrea Enria.

We will then move to the traditional review of SSM annual priorities with Korbinian Ibel, Director General DG4.

Then we will then break the group into 2 sessions.

One on Brexit with Deputy Director Generals Linette Field and Francois-Louis Michaud from the ECB; the Chief Executive of UK Finance, Stephen Jones; and CRO of Eurex Clearing, Dimitri Senko.

The other one on Cybersecurity with Korbinian Ibel, Piers Haben, Director at the EBA, and the Heads of Cybersecurity of Intesa Sanpaolo, Giorgio Cusma, Commerzbank, Igor Podebrad; and Santander, Daniel Barriuso.

So whichever session you have chosen, it should and will be absolutely interesting.

But now, I have the pleasure to introduce a special guest today. Andrea Enria, Chair of the SSM, who is new in this Boardroom Dialogue but a veteran in the build-up of the European Central Bank, where he worked in various positions from the very beginning.

Afterwards he took up responsibility as Secretary General of the Committee of European Banking Supervisors, the precursor of the European Banking Authority of which he would later become its first Chair.

Mr Andrea Enria, welcome back to Frankfurt. We are sure that this first encounter with the EBF members will be the first of many fruitful exchanges that will continue contributing to the successful consolidation of the SSM.

I give you the floor.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post 4th SSM EBF Boardroom Dialogue – Introduction by EBF CEO Wim Mijs appeared first on EBF.

]]>Tripartite Social Summit

Wednesday 20 March, Brussels

Introduction by Wim Mijs, CEO of the European Banking Federation

.

Brussels, 20 March 2019

.

AS PREPARED FOR DELIVERY

Ladies and Gentlemen,

I would like to thank the Romanian Presidency of the Council and the European Commission for inviting the European Banking Federation in the Tripartite Social Summit, to present the views of banks.

Family photo of the Tripartite Social Summit, taking place on 20 March 2019, in Brussels.

On behalf of the EBF, I would like to share with you some considerations regarding the societal responsibility of banks vis-à-vis individuals, companies and governments arising from their essential role of financing the economy.

The EBF promotes the implementation of the Investment Plan for Europe to foster jobs, growth and investments.

Also, as responsible partners, several European banks have already embraced sustainability as a key element in their business strategy.

We fully support the ambition of the European Union to be at the forefront of climate change and energy transition initiatives in order to achieve the objectives set out in the Paris Agreement and in the Sustainable Development Goals of the United Nations.

The EBF is one of the first endorsers of the UN Environment Programme Finance Initiative aimed at launching a corpus of principles for responsible banking.

Within the Social Europe, the banking sector strives to address social challenges deriving also from digitalisation.

We consider the social aspects of the Digital Single Market crucial both in terms of customers and human resources. Being also representatives of banks as employers, we are mindful that the digitalization of banking has determined new working modalities and customer expectations and we are in on-going dialogue with our European Social Partners on related issues.

Moreover, we are conscious that public-private partnerships are necessary to ensure customers’ inclusion and a safe use of digital banking services by enhancing digital skills and cybersecurity awareness. At the EBF we are particularly active to that end.

Governments, employers and workers should continue and intensify cooperation in order to close the skills gap of existing employees and adapt education curricula to better prepare future employees.

The European Sectoral Social Dialogue in Banking needs to continue to provide the framework for Social Partners to work closely together in addressing the employment issues arising from digitalization and regulation.

Thank you very much.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post Tripartite Social Summit – Intervention by EBF CEO Wim Mijs appeared first on EBF.

]]>4th SSM & EBF Boardroom Dialogue

Thursday 7 March, Frankfurt

ECB Supervision Chair Andrea Enria addresses representatives of leading European banks

.

FRANKFURT, 07 March 2019 – The European Banking Federation hosted the fourth SSM & EBF Boardroom Dialogue in Frankfurt today, bringing together industry supervisors at the European Central Bank with more than a hundred senior representatives of leading European banks.

The SSM-EBF Boardroom Dialogue was created to facilitate direct discussions between industry and supervisors in 2015, shortly after the European Central Bank launched the Single Supervisory Mechanism that manages the supervision of the 119 largest banks in the Eurozone.

Opening this year’s meeting, Wim Mijs, Chief Executive Officer of the EBF, said that banks have continued to adapt themselves to the new banking landscape during the last four years, while

Andrea Enria, the new Chair of the ECB’s Supervisory Board, with Wim Mijs, Chief Executive Officer of the EBF. Photo: EBF

embracing the many other challenges that banks face.

“Not only financial stability is an objective of today’s banking sector, but also understanding rapidly changing customer preferences, adapting to the challenge of digital transformation and doing all this in a low-interest rate environment. These are significant challenges for the banking system in the next years to secure their primary role as providers of funding to the economy,” said Mr. Mijs.

CLICK HERE to read Mr Mijs’ intervention.

Making one of his first public appearances since his appointment at the beginning of this year, ECB’s Supervisory Board Chair Andrea Enria said that transparency – both for the ECB and for banks – has become a key issue.

“As supervisors we must be more transparent and explain our decisions not only to banks, but also to investors and the public. This is crucial in a world where investors may get bailed in and where supervisors want to rely more on judgment,” Mr. Enria said.

“We are confronted with requests for radical change, often fuelled by discontent. People have been losing faith in the idea that the European project can make their lives better. I believe that it does make our lives better – from fundamental values such as lasting peace to small conveniences such as the ban on roaming charges; from exciting adventures such as the EU Space Programme to more sober endeavours such as European banking supervision.”

“But explaining ourselves better is not enough. We also need to listen more carefully. Only then will we understand the true nature of problems and the sources of discontent. And only then will we find the right policies to address them. As one of the founding fathers of the EU, Altiero Spinelli, once said, the quality of an idea is measured by its ability to rise again after failures. This is the overarching challenge we all face.”

CLICK HERE to read Mr Enria’s speech on the ECB website.

Related post:

Third SSM & EBF Boardroom Dialogue CLICK HERE

.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post 4th SSM & EBF Boardroom Dialogue, Frankfurt appeared first on EBF.

]]>DO YOU CARE ABOUT EUROPEAN FINTECH REGULATION?

Today’s legislation is drafted in Brussels, the EU capital. Upcoming regulations (PSD2, GDPR) affect the global financial market and all participating actors. The EBF is launching a hub/platform on EU-level financial regulation and FinTech policy, aimed at ALL stakeholders in the FinTech ecosystem.

WHAT DO WE OFFER?

- High-level access to EU policy makers and banking stakeholders

- A seat at the table with decision makers

- Tailored policy advice from leading EBF experts on key FinTech issues

- Regular EU FinTech meetups in Brussels

SIGN UP TO STAY INFORMED:

RELATED DOCUMENTS:

LATEST FROM EBF ON FINTECH

The post DO YOU CARE ABOUT EUROPEAN FINTECH REGULATION? appeared first on EBF.

]]>Digital Single Market: EBF supports innovative, competitive strategy giving confidence for consumers and businesses

EBF advisor: Noémie Papp

Publication date: 10 May 2017

The European Commission today published the mid-term review of its Digital Single Market strategy.

The Digital Single Market, or DSM, is unquestionably an opportunity for all operators willing to embrace the digital transformation. The EBF supports the creation of a DSM which seeks to boost growth, competitiveness, innovation while preserving security, privacy and consumer rights.

The EBF in particular welcomes the following initiatives announced in the presentation of the mid-term review :

- Free flow of data: The EBF fully supports any EU initiative that could remove restrictions to the free flow of data which at the same time acknowledges the right that businesses have to choose where they store their own data.

- Cybersecurity: The battle against cybercrime is of paramount importance in order to ensure the effective delivery of the Digital Single Market. Indeed, the trust of both citizens and companies in digital services and offerings cannot be taken for granted and must have the appropriate digital security. All efforts related to data protection and privacy are only as good as the security is efficient. The EBF therefore appreciates further actions in this field, in particular enhancing collaboration, cooperation and convergence within and between the European and international levels with an efficient framework and networks for information sharing and reporting.

- Digital skills: As a member of the Digital Skills and Jobs Coalition (DSJC) the EBF encourages a swift implementation of the New Skills Agenda and further efforts from the Member States to improve the basic digital skills for all through education curricula and life-long learning. It is in line with the work conducted by the EBF and its members in the context of the European Money Week which take place every year (see http://www.europeanmoneyweek.eu/)

The DSM should encourage the development of financial technology and bring dynamism and competition into the financial sector, both for incumbents and new entrants. This without exposing the financial sector to new risks or significant potential failures which could endanger the financial stability, loss of public confidence, or creating an uneven regulatory framework, in particular when it concerns the access, transfer and re-use of data.

In order to develop digital financial services the European Commission should conduct further assessment with a proportionate approach taking into account its ‘Better Regulation initiative’. Any new legislative initiative must not unduly constrain financial technology companies from providing an effective response to the challenges posed by digitalisation.

Click here for the full announcement made today by the European Commission.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EC presents mid-term review of digital strategy appeared first on EBF.

]]>EBF intervention at the Tripartite Social Summit on

“The future of Europe: charting the course towards

growth, employment and fairness”

Publication date: 08 March 2017

Tripartite Social Summit

Ladies and Gentlemen,

On behalf of the European Banking Federation, I would like to contribute three points to the discussion:

European banks believe in and abide to the fundamental European value of protecting workers and industries. Banks are traditionally offering high standard employment conditions and are committed to finding solutions to employment issues through Social Dialogue. Looking back, at EU level, we have concluded with our Social Partners Joint Statements and Recommendations on a number of important issues such as IT-Employability in the Banking Sector, Lifelong Learning, and Corporate Social Responsibility, and have launched initiatives to enhance financial literacy: the annual European Money Week and the Financial Education Platform are EBF flagships. Moreover, as “Triple A” is a concept coming from the financial sector, we believe we can continue to be “Triple A employers” in the future.

However, there are challenges. Employment in the banking sector is not immune to the emergence of new technologies and, with them, the changes in consumer preferences that have led to digital banking. The Digital Single Market is a fantastic opportunity for banks and Social Dialogue is a key element in our adaptation to this new environment. Two main issues to be considered here:

- Banks need to acquire new talents to seize the new business opportunities related to innovation. We are already investing heavily in financial technology. But this is not enough. We need our educational system to be re-oriented towards the digital economy. This is important, if Europe is to maintain its global competitive standing, also in banking.

- Retraining policies are also essential. I cannot stress enough how important digital skills are! Our workers have to acquire the digital skills that will enable them to adapt to the new ways of service delivery. Banks are willing to take action in this respect by becoming members of the European Union’s Digital Skills and Jobs Coalition, an initiative for which I would like to warmly congratulate the Commission.

Last, the future of banking in Europe is streamlined by the evolution of the Banking Union, which we strongly support. The related regulatory developments will have an impact on business models and time will tell how much a single rulebook and a single supervisory system will contribute to that. These processes will certainly affect employment levels in our sector. In addition to our efforts for the acquisition of new talents and the re-training of our current employees, the possible emergence of pan-European banks could put worker mobility and transferable skills issues in the scope of our discussions with our Social Partners in the years to come.

Everything I have said will only work in a strong and healthy European Union. I do believe that Europe has brought us much and we will certainly celebrate with you the 60th anniversary of the Treaties of Rome for what Europe has brought us and what it will still bring us!

Thank you very much.

Wim MIJS

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF intervention at the Tripartite Social Summit on “The future of Europe: charting the course towards growth, employment and fairness” appeared first on EBF.

]]>