EBF economists forecast Euro area GDP growing by 1.2 percent in 2019 and by 1.4 percent in 2020

BRUSSELS, 15 May 2019 — The chief economists’ group of the European Banking Federation expects the Euro area economy to keep expanding, albeit close to potential for the time being. We foresee the Euro area GDP growing by 1.2 percent in 2019 and with a modest pick up to 1.4 percent in 2020.

- European banks see inflation subdued. We forecast an inflation rate of 1.3 percent in 2019 and 1.5 percent in 2020.

- Core inflation, projected to be 1.2 percent in 2019 and 1.4 percent in 2020, will gradually converge towards headline inflation.

- Labour markets will continue to improve over the forecast horizon. The jobless rate is seen at 7.7 percent in 2019 with a further improvement to 7.5 percent in 2020.

Risks to the scenario

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. Upside risks

- US economy to continue expanding, albeit at a lower pace together with signs of a stabilisation and recovery in China’s growth offsetting uncertainties in emerging countries.

- Global economy gaining moderate momentum in 2020. Also, provided that international trade dispute does not intensify further, global trade will pick up again supporting the export economies in the Euro area.

- Although a no-deal exit remains probable, Brexit negotiation extension could help bring an outcome that is economically acceptable.

- A rebound in Germany’s performance in the course of 2019 with, in particular, possible recovery of industrial production, mainly in the automobile sector.

- Fiscal policy in the Euro area is becoming more expansionary.

2. Downside risks

- Worsened trade outlook with rising trade tensions between the US and China triggering a trade battle that would harm global economy. The Euro area economy, that is relatively highly exposed to external trade, would be severely hit if EU-US trade frictions materialise and US tariffs are imposed on, for example, EU automotive exports.

- Upward pressure on oil prices coming mainly from an escalation of geopolitical risk, in particular in Iran and Venezuela.

- High debt levels and weak growth in Italy, Euro area’s third biggest economy.

- Brexit and the uncertainty around the final outcome remains a major concern.

- Weak manufacturing sentiment spreading to the broader economy.

- Political uncertainty at a broad European level with Eurosceptics gaining attraction in some countries ahead of European elections.

The risks to the growth outlook are tilted to the downside, according to the Chief Economists’ Group.

For more information:

Francisco Saravia, Advisor Prudential Policy and Supervision

f.saravia@ebf.eu

+32 2 508 3711

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF Spring Outlook in Euro Area Economy 2019-2020 appeared first on EBF.

]]>Economic Outlook: uncertainty dims Euro area growth

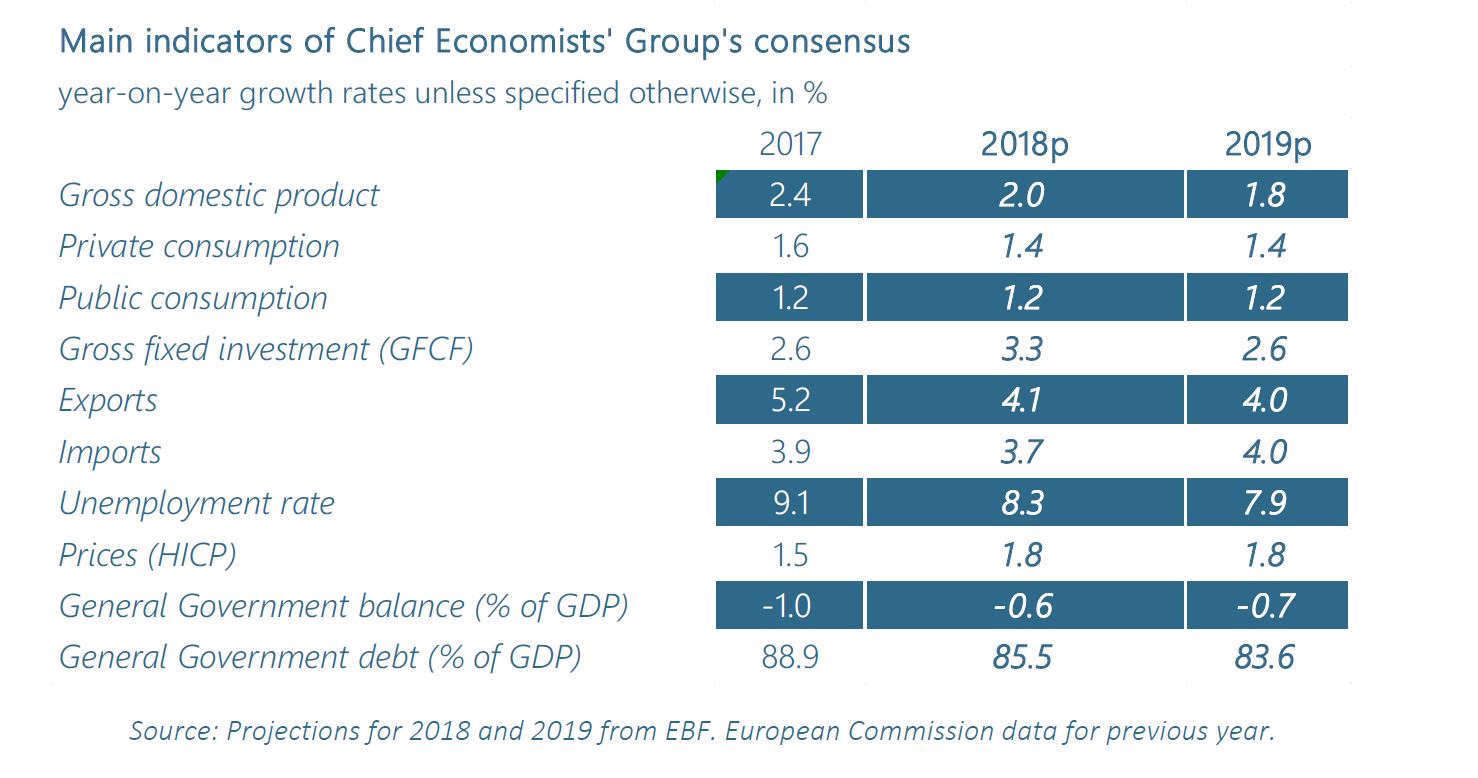

EBF economists forecast Euro area GDP growing by 2.0 percent in 2018 and by 1.8 percent in 2019

Publication date: 26 November 2018

k

EBF adviser: Francisco Saravia

EBF economists forecast Euro area GDP growing by 2.0 percent in 2018 and by 1.8 percent in 2019

The Chief Economists’ Group of the European Banking Federation expects economic growth in the Euro area to continue above trend, albeit at a lower pace, and despite lower growth dynamics expected for the next quarters to come. The slowdown in the pace of the economic growth in the 19-country bloc is mainly attributed to temporary country-specific factors and an easing of foreign demand. The Euro area economy will continue growing in the forecast period benefiting from sustained domestic demand, accommodative monetary and fiscal policies, and strong labour market performance. The main downside risks remain the internal uncertainty illustrated by political jitters in Europe and an external environment with weaker global trade and lingering protectionism. We expect the Euro area to expand, offsetting uncertainty and tempered global demand, by 2.0 percent in 2018. Growth is expected to cool down slightly in 2019 with a projected GDP growth of 1.8 percent.

Highlights from the EBF forecast:

- The Euro area economic growth will continue to expand, albeit at a lower pace. We foresee the Euro area GDP growing by 2.0 percent in 2018 and by 1.8 percent in 2019.

- European banks see inflation stabilising. With our forecast of an inflation rate of 1.8 percent in 2018 and 2019, the ECB’s medium-term objective of price stability -below, but close to 2.0 percent- is more or less achieved.

- Public finances have improved. The Euro area’s general government budget deficit will be 0.6 percent of GDP in 2018, down from 1.0 percent in 2017. In 2019, it will remain about the same level i.e. 0.7 percent of GDP.

- Labour markets will continue to improve over the forecast horizon. The jobless rate is forecast to be 8.3 percent in 2018 with a further improvement to 7.9 percent in 2019.

kkkk

Risk to the scenario

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. Upside risks

- Soft landing of the US economy accompanied by neutral monetary policy.

- Stronger than expected domestic demand growth if wage dynamics pick up more decisively.

- Expansionary fiscal policies in some Euro area countries (which have real budgetary room for manoeuvre), potentially bringing support to Euro area economic growth.

- Stabilisation of global economic activity leading to slight acceleration of Euro area exports.

- Succesfull political monitoring of the ‘Italian risk’ and a Brexit outcome that is economically acceptable.

2. Downside risk

- Escalation of the fiscal conflict in Europe with a clash between the European Commission and Italy -Euro area’s third biggest economy- over Italy’s government budget plans.

- Worsened trade outlook with further escalation of trade tensions between the US and China triggering a trade battle that would harm the global economy. The Euro area economy, that is relatively highly exposed to external trade, would be severely hit if EU-US trade frictions materialise and US tariffs are imposed on EU sectors.

- Although negotiations between the European Union and the United Kingdom seem to be progressing, as seen by the recent draft agreement on the withdrawal of the United Kingdom from the European Union, the final outcome remains a major concern.

- Further slowdown of global growth with weakened emerging economies.

- Increasing geopolitical tensions having the potential to spark a period of further decline in world trade.

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF Autumn Economic Outlook: uncertainty dims Euro area growth appeared first on EBF.

]]>Wim Mijs at the Paris Fintech Forum – PSD2 & Fintech collaboration

23 May 2018 – EBF CEO was honoured to represent the interests of the European Banking Federation at the Paris Fintech Forum on 30 & 31 January 2018. The conference, which took place at the Palais Brongniart which welcomed more than 2500 attendees from 72 countries.

PSD2 is here – what now?

Wim Mijs participated at the panel discussion addressing the challenges of PSD2 and its EU-wide implementation. Banks and many other companies are using the new rules to enable and shape more innovation in payments but new risks are also emerging.

Panellists:

Moderated by: Pascal Bouvier, Partner at Santander InnoVentures

Wim Mijs, Chief Executive Officer, European Banking Federation

Edouard Fernandez-Bollo, Secretary General, ACPR (Banque de France)

Carlos Sanchez, CEO & Co-founder, Ipagoo,

Adam Farkas, Executive Director, European Banking Authority

Banks & FinTech cooperation – what is behind the curtain?

In the second panel which Wim Mijs participated, panellists noted the diversity of bank fintech collaboration models and provided perspectives on how to move forward.

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/KSCjTtrqFdo?rel=0″ frameborder=”0″ allow=”autoplay; encrypted-media” allowfullscreen></iframe>

Panellists:

Moderated by: Edward Robinson, Senior Writer, Bloomberg

Wim Mijs, Chief Executive Officer, European Banking Federation

Tamaz Georgadze, CEO, Raisin

Teppo Paavola, Chief Development Officer New Digital Business, BBVA

Ramin Niroumand, CEO, FinLeap

Johan Lindstrom, Senior VP Business Development Europe, Mastercard

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post Video: Wim Mijs at Paris Fintech Forum on PSD2 & Fintech appeared first on EBF.

]]>Economic outlook: recovery at cruising speed

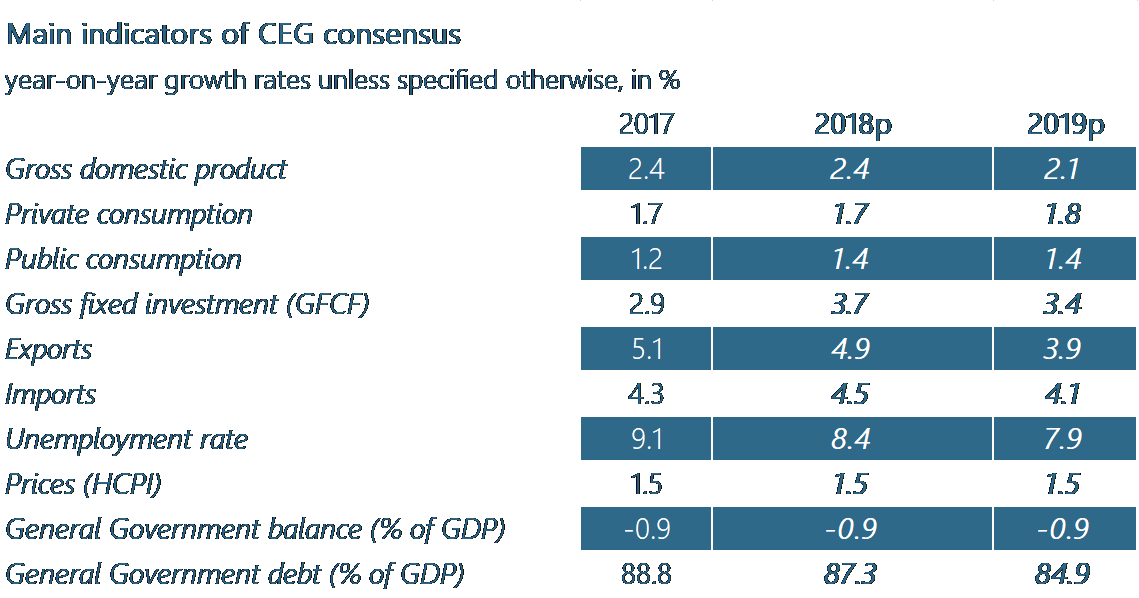

EBF economists forecast 2.4% GDP growth for eurozone in 2018, 2.1% for 2019

Publication date: 8 May 2018

EBF economists forecast 2.4% GDP growth for eurozone in 2018, 2.1% for 2019

The chief economists’ group of the European Banking Federation expects economic growth in the Euro area to continue growing at a steady pace this year. The 19-country block will continue benefiting from supportive financial conditions, sustained global and domestic demand, and robust growth of global economy. While political uncertainty in Europe is less of a threat than in previous years, geopolitical tensions and escalation of a possible trade conflict remain downside risks. We expect the Euro area to expand, above potential, by 2.4 percent in 2018. The growth is expected to slacken slightly in 2019, when we foresee a GDP expansion of 2.1 percent.

Highlights from the EBF forecast:

- The Euro area economic growth will expand at a steady pace. We foresee the Euro area GDP growing by 2.4 percent in 2018 and by 2.1 percent in 2019.

- European banks see inflation stable. We expect consumer prices to increase by 5 percent annually over the coming years.

- Public finances will continue to improve. The Euro area’s general government budget deficit will be 9 percent of GDP in 2018 and 2019, down from 1.5 percent in 2016.

- Labour markets will continue to improve over the forecast horizon consolidating the economic recovery phase. The jobless rate is forecast to be 8.4 percent in 2018 with a further improvement to 7.9 percent in 2019.

Source: Projections for 2018 and 2019 from EBF. European Commission data for previous year.

kkkk

Risk to the scenario

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. Upside risks

- Solid growth of the world economy allowing the Euro area to continue growing above potential and making the 19-country bloc more resilient to external shocks.

- Expectations for higher private consumption, good pace of growth for public consumption and the fixed gross capital formation. Also, stronger economic momentum leading to higher investments.

- An even longer period than currently expected with extremely lenient monetary conditions.

2. Downside risk

- Although the uncertainty related to the political events in Europe has diminished, geopolitical tensions have the potential to spark a period of instability disturbing buoyant global growth.

- Trade tensions between the US and China may trigger a trade battle that would harm the recovery of the global economy. The Euro area, that is relatively highly exposed to external trade, would be severely hit if EU-US trade frictions start and US tariffs are imposed on EU sectors.

- Although negotiations between the European Union and the United Kingdom seem to be progressing in the right direction with the conclusion of the first stage of negotiations, the final outcome and next stage i.e. trade negotiations, remain a major concern.

- Sudden increase in inflation leading to sooner than expected tightening of monetary policy.

The risks to the growth outlook are fairly balanced, according to the Chief Economists’ Group.

EBF adviser: Francisco Saravia

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF Spring Economic Outlook: recovery at cruising speed appeared first on EBF.

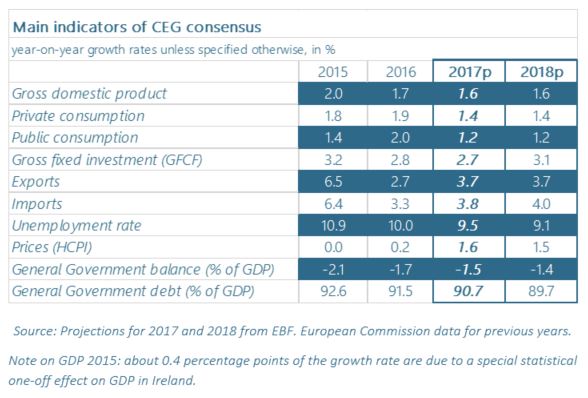

]]>EBF 2017 Spring economic outlook for the euro area: IN NEED OF POLITICAL CERTAINTY

EBF adviser: Francisco Saravia

Publication date: 4 May 2017

THE EBF FORECAST FOR THE EURO AREA ECONOMY:

- The economy will continue its recovery, albeit at a marginal slower pace, amid continuing high political uncertainty. We foresee the euro area GDP growing a moderate 1.6 percent in 2017 and 2018.

- European banks see a substantial recovery of inflation ahead. We expect consumer price inflation to have a substantial rise to 1.6 percent in 2017 and decelerate slightly to 1.5 percent in 2018.

- Public finances will continue to adjust slowly: the euro area general government budget deficit will be 1.5 percent of GDP this year, and 1.4 percent of GDP in 2018.

- Economic growth is expected to be sufficiently strong to ensure that labour markets will continue to improve over the forecast horizon. The jobless rate is forecast to be 9.5 percent in 2017 and 9.1 percent in 2018.

THE EBF CHIEF ECONOMISTS’ GROUP CONSENSUS

The Chief Economists’ Group of the European Banking Federation expects the euro area to continue the economic recovery supported by a highly expansive monetary policy, stronger labour markets and a better global outlook. GDP growth is forecasted to reach 1.6 percent in both 2017 and 2018. However, growth could be stronger if it was not for the significant political uncertainty and geopolitical tensions which are presently surrounding the world economy. These risks keep investment activity and world trade low in comparison to periods of more stable and better predictable external conditions.

While private consumption has been an engine for growth in Europe, the rising inflation will take its toll of consumption also corresponding with a diminished GDP growth compared to previous years. We expect private consumption to grow by 1.4 percent in both 2017 and 2018. Fixed business investments will grow by 2.7 percent in 2017 and slightly strengthen throughout 2018 to a 3.1 percent growth.

Inflation is currently expanding by its fastest pace in several years largely due to the rising oil prices. This will push the increase in consumers’ prices to 1.6 percent in 2017, up from 0.2 percent in 2016, while the inflation rate will decelerate slightly to 1.5 percent in 2018. This scenario suggests that inflation will, for first time in years, lie closer to the ECB target of price stability; close to, but below 2.0 percent. Core inflation (which excludes volatile items like commodities, energy and non-processed food) is however increasing at a somewhat lower rate of just 1.1 percent in 2017 and 1.3 percent in 2018.

Growth stabilization in most emerging countries and solid growth in the advanced economies will help to reach a gradual recovery of the global economy which should enhance European exports. We thus forecast exports to grow by 3.7 percent this year and next.

Economic growth is expected to be sufficiently strong to ensure that labour markets will continue to improve over the forecast horizon. After reaching 10 percent in 2016, our forecast for the euro area foresees unemployment at 9.5 percent in 2017, with a further improvement to 9.1 percent, in 2018, the lowest rate to be recorded in the euro area in a decade. These figures will continue to mask uneven rates across the euro area countries in which the unemployment rate remains high. The unemployment, still high, will keep wage pressures contained. Our consensus expects wages to increase by 1.6 percent in 2017 and a slightly higher 1.8 percent in 2018.

Oil prices fell by some 75 percent during 2014 and 2015, before recovering sharply in 2016. On back of the expectation that the OPEC countries will stick to their current production quotas our consensus forecast for the oil price (Brent) in 2017 is around USD 55 and USD 59 in 2018.

The ECB is expected to begin a gradual reduction of the expansionary monetary policy during the forecast horizon. This is expected to lead to a slight appreciation of the euro against the dollar from the end of 2017. The Chief Economists’ Group’s consensus forecast for the euro/dollar exchange rate in 2018 is 1.11 with a relative wide margin between 1.05 and 1.20.

RISK TO THE SCENARIO

The CEG’s consensus remains surrounded by a number of both upside and downside risks.

1. UPSIDE RISKS

- A faster recovery of the global economy as global trade is slowly gaining some strength and confidence indicators remain strong, implying a self-fulfilling upswing.

- The President Juncker’s Investment Plan for Europe may start generating effects, albeit moderate in the economy, thus supporting the euro area growth in 2018.

2. DOWNSIDE RISK

- The uncertainty related to the political events in Europe with France, Germany and possibly Italy holding elections later in the year. Disrupting outcomes may trigger prolonged uncertainty.

- The level of complexity of the Brexit negotiations and the relative short time (until March 2019) in which to reach a final deal.

- Increasing global protectionism, in particular, by an aggressive US trade policy, could trigger trade conflicts that would harm the global economy.

- The slowdown of the Chinese economy might well materialise which would, inter alia, affect the euro area’s trade exposure and investment to China.

The risks to the growth outlook are fairly balanced, according to the Chief Economists’ Group

Latest posts

- EU T+1 Industry Committee launches roadmap and opens consultation period for capital markets transformation

- European Credit Sector Associations welcome efforts to strengthen European retail payments

- The EU T+1 Industry Committee finalises High-Level Road Map

- Vacancy: Innovation and Cybersecurity Trainee

- New study stresses urgent need for regulatory capital efficiency

Subscribe to the EBF Weekly + FinReg Agenda

Every Friday at noon you can receive the EBF Weekly + Financial Regulation Agenda. This agenda presents an overview of upcoming European and international meetings and conferences in financial regulation, as well as important general financial and economic events and key EBF meetings for the week ahead. CLICK HERE TO SUBSCRIBE

Subscribe to the EBF Morning Brief

The EBF Morning Brief is published Monday through Friday morning and brings you the top banking headlines, relevant announcements from the EU institutions and the latest from the EBF and its members, national banking associations in 32 countries in Europe. CLICK HERE TO SUBSCRIBE

The post EBF 2017 Spring outlook for euro economies appeared first on EBF.

]]>